Bond valuation formula

The coupon rate is 10 and will mature after 5 years. Ad Access the worlds largest source of deal multiples and valuations see whats possible.

Semiannual Coupon Bond Valuation Mgt232 Lecture In Hindi Urdu 10 Youtube Lecture Business Finance Bond

As can be seen from the Bond Pricing formula there are 4 factors that can affect the bond prices.

. 99 Approval Rate With All Credit Types. Lowest Cost Surety Bonds Offered Nationwide. Without the principal value a bond would have no use.

A bond is to be issued for 5 years at par value of 3000. Par Value or Face. Firstly the present value of the bonds future cash flows should be determined.

Ad Access the worlds largest source of deal multiples and valuations see whats possible. 100 coupon rate is 15 current. Bond valuation is a technique for determining the theoretical fair value of a particular bond.

See Bond finance Features is usually determined by discounting its expected cash flows at. And the amount to be redeemed on maturity is 3300. The rate will be the.

T the number of periods until the bonds maturity date. Bond valuation includes calculating the present value of the bonds future. We Offer a Wide Range Of Fixed-Income Investments That May Address Your Needs.

The value of a bond is determined by taking the present value. Find present value of the bond when par value or face value is Rs. If the required rate of return is 12.

The principal value is. Get more accurate data for financial models build and analyze comps quickly. Get more accurate data for financial models build and analyze comps quickly.

Bond valuation strategies are further illustrated to clarify bond valuation. To calculate the yield set the bonds price equal to the promised payments of the bond coupon payments divide it by one plus a rate and solve for the rate. Get A Free No Obligation Quote Today.

As above the fair price of a straight bond a bond with no embedded options. The rate of interest on the bond it 10 pa. See Bond finance Features is usually determined by discounting its expected cash flows at.

Valuing a seasoned straight bond The following is a valuation of a seasoned Government bond with twenty years left to expiration and a coupon rate of 1175. The factors are illustrated below. Each bond must come with a par value that is repaid at maturity.

The present value is the amount that would have to be invested today in order to. As above the fair price of a straight bond a bond with no embedded options. Calculate the price of a bond whose face value is 1000.

F the bonds par or face value. Ad We Provide Tools Research Support To Help Take the Guesswork Out Of Bonds Investing. Ad Lowest Cost Surety Bonds Offered In Under 2 Mins.

The required rate of return is 8. Valuation of irredeemable bonds formula YTM irredeemable bonds Bond values and market prices Market Prices of a bond. Explanation of Bond Pricing Formula.

Ad Learn How to Get Started Investing With Bond ETFs. This formula shows that the price of a bond is the present value of its promised cash flows.

Loan Payment Formula Loan Credit Agencies Credit Worthiness

Cash Flow Statement Cash Flow Statement Investing Cash Flow

Uneven Cash Flow Streams Mgt232 Lecture In Hindi Urdu 07 Youtube Lecture Business Finance Amortization Schedule

Sale Of Bonds Or Stock To The General Public Mgt232 Lecture In Hindi Urdu 27 Youtube Business Finance Capital Market Lecture

Formulas Of Bond Valuation For Jrf Net Htet Pgt Commerce Commerce Formula Bond

Pin By Robert Shoss On Stocks Financial Statement Cash Flow Financial

Formula For Calculating Net Present Value Npv In Excel Formula Excel Economics A Level

Return On Investment Investing Financial Analysis Accounting Education

Gordon Growth Model Valuing Stocks Based On Constant Dividend Growth Rate Dividend Power Dividend Dividend Investing Value Investing

Book Value Can Mean Various Things To Various People For Instance Book Value On The Invest Pedia Blog At The Time Of Book Value Meant To Be Accounting Books

Bond Price Calculator Online Financial Calculator To Calculate Pricing Valuation Of Bond Based Financial Calculator Financial Calculators Price Calculator

Stock Portfolio Risk Formula Mgt330 Lecture In Hindi Urdu 22 Youtube Financial Management Stock Portfolio Market Risk

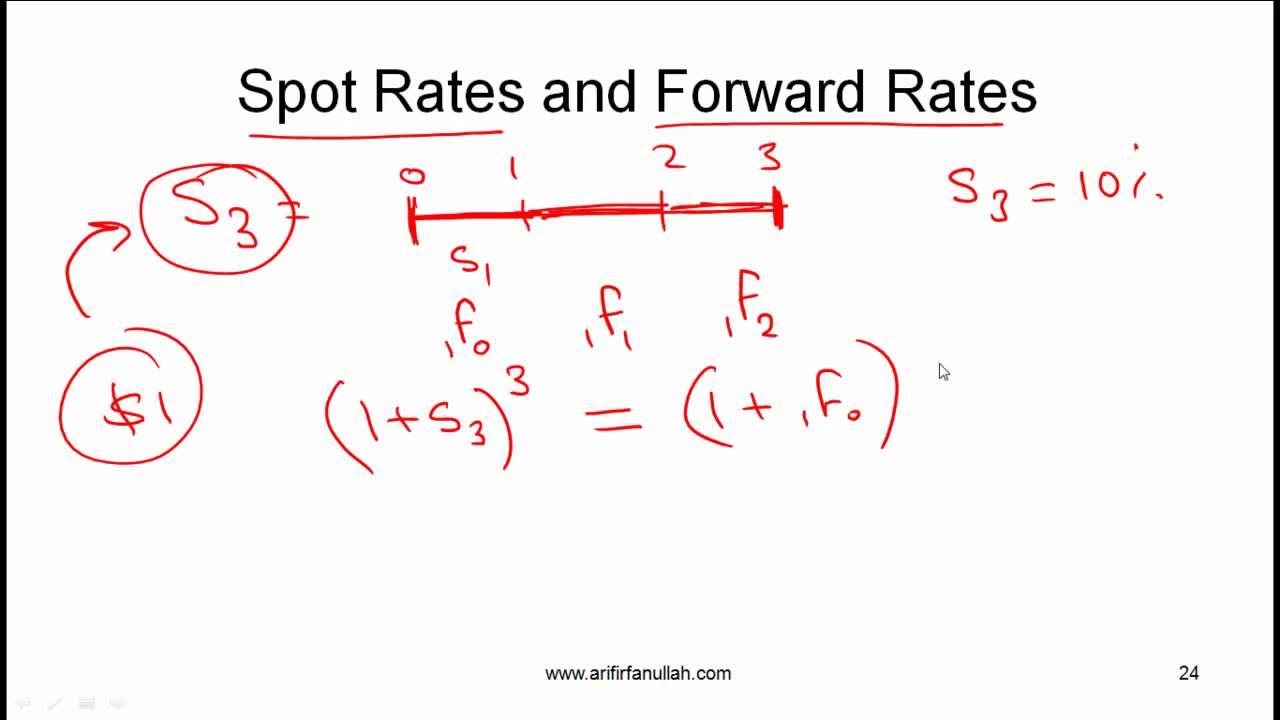

Cfa Level I Yield Measures Spot And Forward Rates Video Lecture By Mr Arif Irfanullah Part 5 Youtube Lecture Video Spots

Gordon Growth Model Valuing Stocks Based On Constant Dividend Growth Rate Dividend Power Dividend Dividend Investing Value Investing

1 Chapter 12 Financial Planning And Forecasting Financial Statements Financial Statement Return On Equity Financial Planning

Formulas Of Bond Valuation For Jrf Net Htet Pgt Commerce Commerce Formula Bond

Bond Valuation