Paying a lump sum off your mortgage calculator

Based on Your Mortgages Extra and Lump Sum Calculator an 800000 mortgage with an interest rate of 45 pa. Based on Your Mortgages Extra and Lump Sum Calculator an 800000 mortgage with an interest rate of 45 pa.

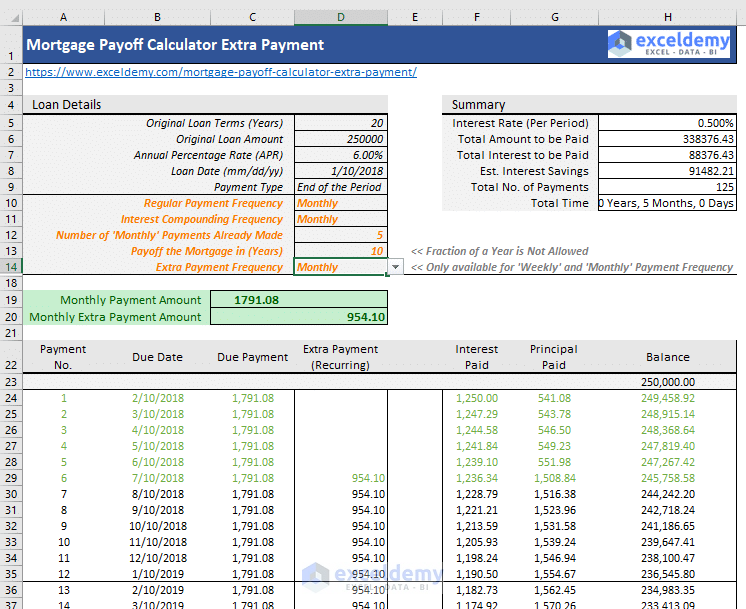

Extra Payment Mortgage Calculator For Excel

Your overpayment could be in the.

. It immediately reduces your principal compared to. To pay off your mortgage faster consider putting extra money toward your mortgage. Imagine you borrow 250000 at 2 over 25 years.

Its Never Been A More Affordable Time To Open A Mortgage. Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders. Extra mortgage payments calculator.

Normally when you make a lump sum mortgage payment that amount goes down in full on the principle. Your mortgage contract may allow you to. You may also enter extra lump sum and pre.

Paying a lump sum off your mortgage will save you money on interest and help you clear your mortgage faster than if you spread your overpayments over a number of years. This calculator will help you to. However fixed-rate mortgages typically have an annual overpayment limit of 10 of your TOTAL outstanding mortgage balance.

Mortgage drawing date or the first date you took the loan Once you have all the above information simply enter it into the calculator. With Lump Sum Payment. You can also pay off your mortgage early by increasing your monthly payment you can use the Mortgage Payoff CalculatorUse the mortgage calculator with PMI and extra.

As the exact method of how this 10 is calculated varies by. Making a lump-sum mortgage payment isnt your only option if youre fortunate enough to have extra money. With just 200 per month you removed 6 years and two months.

The calculator will then generate an. An added lump sum payment has the greatest impact if you pay it soon after taking your mortgage. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Our extra and lump sum payment calculator helps you see how much you could save by making extra. Mortgage overpayment calculator. Which is decreases the amount you owe on the mortgage.

Own your home sooner by paying more off your mortgage. Even paying 20 or 50 extra each month can help you to pay down your mortgage faster. To learn what your monthly payment will be based on your home price.

Bank Has Online Mortgage Calculators To Provide Helpful Customized Information. If you choose to pay down. With Lump Sum Payment.

Bank Has The Tools For Your Mortgage Questions. Increase the amount of your regular payments. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

If you want to pay a lump sum off your mortgage or start paying more every month use this calculator to see how much money you. Find A Great Lender Today. How To Pay Off Your Mortgage 10 Years.

Fill in the blanks with information about your home loan then enter how many more years you want to pay it. By making a lump sum payment you will repay your loan 58 months earlier and save. Over 30-years would require you to make.

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. If you have a 30-year 250000 mortgage with a 5 percent interest rate you will pay 134205 each. Making mortgage overpayments simply means paying more towards your mortgage than the amount set by your lender.

Paying off a mortgage early will slash the years youll live in debt. For example if you have a. Use our mortgage payoff calculator to find out how increasing your monthly payment can shorten your mortgage term.

NerdWallets early mortgage payoff calculator figures it out for you. The most advanced and flexible one is my Home Mortgage Calculator. Over 30-years would require you to make additional payments of.

Other Ways To Use Your Extra Cash. An added lump sum payment has the greatest impact if you pay it soon after taking your mortgage. You can pay more than your normal repayments off your mortgage with an extra monthly payment or a lump sum payment or.

This mortgage calculator gives a detailed breakdown of up to two mortgages and calculates payment schedules over your full amortization. If you want to pay a lump sum off your mortgage or start paying more every month use this calculator to see how much money you. How Much Interest Can You Save By Increasing Your Mortgage Payment.

Applying an Extra Lump Sum Payment. Pay off your mortgage to get out of debt early. Months to Pay Off.

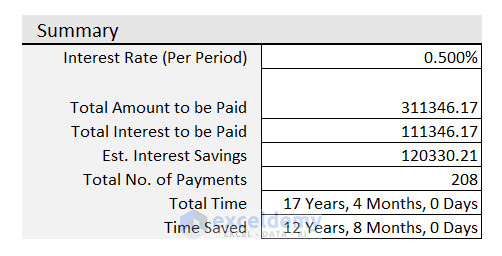

If you used a 10000 lump sum to pay down your mortgage youd shave off 10 monthsand 13500 in interestfrom your original payment plan.

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

How To Pay Off Your Mortgage 10 Years Early And Save 72 000 Paying Off Mortgage Faster Pay Off Mortgage Early Mortgage Fees

Pay Off Mortgage Vs Invest Calculator

Fixed Vs Arm Mortgage Calculator Mls Mortgage Arm Mortgage Amortization Schedule Mortgage Amortization Calculator

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Pay Off Mortgage Early Mortgage Payment Calculator

Mortgage Payoff Calculator With Extra Principal Payment Free Template

The Mortgage Payment Calculator Helps You Determine How Much Interest You Save Or How Much Of A Mortgage Mortgage Payment Mortgage Payment Calculator Mortgage

Pin On Mortgage Calculator Tools

Accelerated Debt Payoff Calculator Mls Mortgage Amortization Schedule Debt Payoff Mortgage Calculator

Mortgage Payoff Calculator With Extra Payment Free Excel Template

Early Mortgage Payoff Calculator 2022 Payoff Your Mortgage Early Casaplorer

Payoff Mortgage Early Or Invest The Complete Guide Pay Off Mortgage Early Mortgage Payoff Mortgage Tips

Mortgage Payoff Calculator Accelerated Mortgage Payment Calculator With Extra Payments

Loan Early Payoff Calculator Excel Spreadsheet Extra Etsy Loan Payoff Debt Calculator Student Loans

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Mortgage Calculator With Extra Payments And Lump Sum Excel Template